Protocols of the Sovereign Social Movement, Part II: Bitcoin and Lightning

Part 2/4 in a series on the four freedom protocols currently changing our world.

This is the second installment in a four-part series on how Bitcoin, Lightning, Nostr, and Ordinals are combining to form the protocol-basis of a burgeoning social movement advancing the cause of liberty. To read Part I, go here.

In Part II, we will unpack Bitcoin and Lightning from the perspective of their use-cases as censorship resistant value storage and transfer protocols. It is weighted towards Lightning, given that this is the protocol that is going to allow Bitcoin to scale to the level of true global adoption, but still includes links to start learning about Bitcoin itself if you are just starting out.

Bitcoin, the Grand-Daddy of the Sovereign Social Movement

“You print a couple trillion dollars and people start to get concerned. And out of that concern, we have something called a bitcoin.” - Some CNBC anchor, probably

“This is where Bitcoin shines, a decentralized, peer-to-peer electronic cash system. With no central authority to deny transactions based on some floating moral standard, peers within the Bitcoin network can transact free from anyone’s permission. No government blacklist or class action lawsuit can stop a Bitcoin transaction from going through.” - Econoalchemist

In “The Age of Surveillance Capitalism,” Zuboff calls for a new social movement to reclaim the rights and values that are being undermined by the age of surveillance capitalism and the authoritarian repression it is enabling in western democracies. Although she didn’t reference it in her book, that social movement had already begun in earnest on October 31st, 2008 when Satoshi Nakamoto released the Bitcoin white paper.

In a post on bitcointalk.org a few weeks after he launched Bitcoin live on mainnet, Satoshi expounded upon his motivations for creating Bitcoin:

For every action, there is an equal and opposite reaction. In the wake of the unprecedented fiscal response to the Global Financial Crisis, a peer-to-peer, trustless, and censorship resistant protocol for transacting value was born of immaculate conception in protest.

Oceans of ink have been spilled on the topic of bitcoin as the first, most important, and only relevant cryptocurrency in existence today. If you are still at the edge of your personal bitcoin rabbit hole, you can start diving in here, here, or here.

The salient point here is that Bitcoin is the base layer protocol for the Sovereign Social Movement tech stack. It is a globally decentralized, censorship resistant, absolutely scarce digital bearer asset and final settlement network, secured and constrained by billions of dollars of physical infrastructure and billions of watts of electricity, and governed through a globally distributed democratic system of consensus. It is the final settlement layer upon which the Sovereign Social Movement is being built, and adoption is growing rapidly.

But this base layer is purposefully limited - blockspace is scarce and will remain so, throttling layer one transaction throughput. To truly scale into a broadly adopted global monetary network, it needs an elegant transaction solution that allows billions of people around the world to exchange value near instantly, simultaneously, and affordably. That solution is Lightning.

Lightning, the L2 solution that will scale sovereign, censorship resistant value transfer globally

“Lightning is a bitcoin payment network that reduces transaction times from minutes to milliseconds and transaction fees from several dollars to a few cents or less. Lightning turns bitcoin from digital gold into digital currency while preserving all of the benefits that make bitcoin great.” - Breez Documentation

“The bitcoin protocol can encompass the global financial transaction volume in all electronic payment systems today, without a single custodial third party holding funds or requiring participants to have anything more than a computer using a broadband connection.” - The Bitcoin Lightning Network: Scalable Off-Chain Instant Payments

The Lightning Network is a second-layer payment protocol built on top of Bitcoin that allows for faster and cheaper transactions. It is a decentralized network of micropayment channels between individual nodes, designed to solve bitcoin’s scalability problem. If you’re starting out on your Lightning journey, this is a good first stop.

To understand why Lightning is necessary for true global adoption of bitcoin, you need only compare transaction volumes between Visa and bitcoin. Below is the average daily transaction count on the Visa network for FY2018-2022. According to WallStreetZen, Visa handled an average of 707,000,000 transactions per day in FY2022. This indicates a Visa transaction throughput rate of roughly 8200 transactions per second.

Bitcoin, on the other hand, hovered right around 250,000 transactions per day in 2022. Assuming a block-size limit of 4 megabytes, an average interblock time of 10 minutes, and an average bitcoin transaction size of 600 bytes (the recent advent of Ordinals notwithstanding), bitcoin has a theoretical transaction throughput limit of roughly 11 transactions per second. In the last 7 days according to Hashrate Index, the network has averaged 3.7 transactions per second. Not only does this significantly throttle transaction throughput relative to other global payments networks, it also suggests that if and when demand to include transactions into scarce block space increases, transaction fees would become prohibitively expensive for most users.

Thus, the Lightning Network was born. From the 2016 white paper that specified the Lightning Network’s logic and parameters:

“While it is possible to scale at a small level, it is absolutely not possible to handle a large amount of micropayments on the [bitcoin] network or to encompass all global transactions. For bitcoin to succeed, it requires confidence that if it were to become extremely popular, its current advantages stemming from decentralization will continue to exist. In order for people today to believe that Bitcoin will work tomorrow, Bitcoin needs to resolve the issue of block size centralization effects; large blocks implicitly create trusted custodians and significantly higher fees.

Though there are arguments that suggest bitcoin could “succeed” as a final settlement and digital bearer asset designed explicitly for extremely high-value storage and global transactions without solving the scaling problem, there is broad consensus in the community that Lightning is our best chance at a high percentage of global adoption.

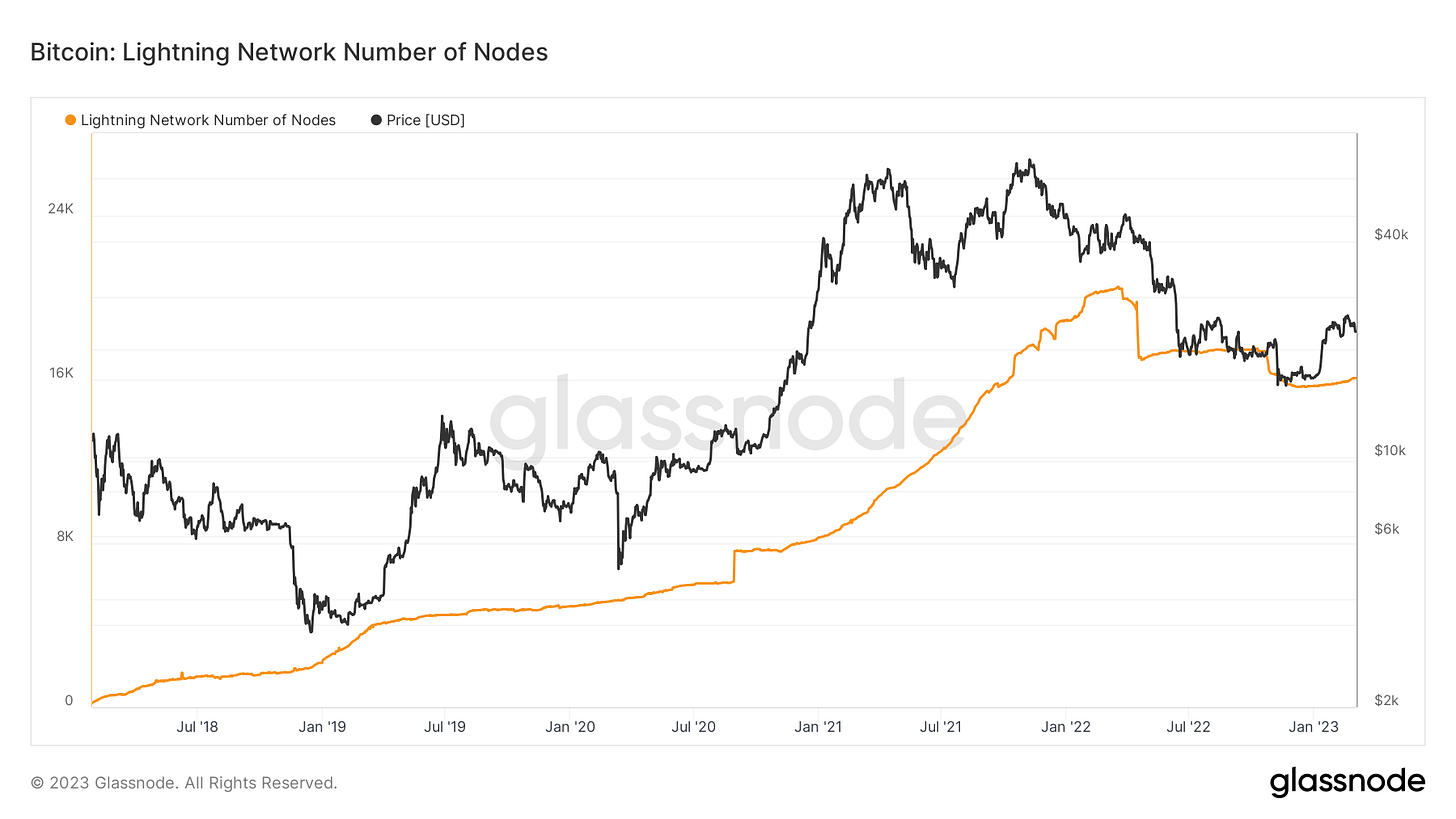

Since the release of the Lightning Network white paper in January 2016, the protocol has matured in fits and starts. Initially, adoption was hampered by the high technical proficiency required to run a node, manage channels, and balance inbound and outbound liquidity. Recently, however, development on the network has started to grow exponentially, with VC capital pouring into the space and specialization of products and services allowing for the abstraction of technical complexity and a significantly improved UI/UX. Although some simplifying products and services come with their own trade-offs (e.g. counter-party and privacy risk with custodial service providers), generally speaking the ecosystem of products and services is growing rapidly while preserving most of the benefits of bitcoin as envisioned. One metric of growth is node-count:

Lightning nodes open channels with other nodes, send and receive payments, and route payments from other users.

These nodes can be professional node operators like Lightning Service Providers, which provide channel liquidity for Lightning Network users. They can be merchants that run nodes in order to be able to accept bitcoin payments for goods and services utilizing the Lightning network. They can be individuals attempting to generate yield on significant personal bitcoin holdings (learn what it takes to run a profitable Lightning node here). Or they can be individual users that send and receive value instantaneously via bitcoin over the Lightning Network through the use of software wallets that run nodes in the background on their phones or computers.

As of March 5th, 2023, there are 16,309 visible nodes on the Lightning Network, with 5,385.38 BTC worth of capacity locked or circulating in the network.

Per Glassnode, Lightning Network Capacity can be defined as the total amount of BTC both locked, and circulating within the Lightning Network. As River Financial, the fourth largest Lightning node operator in the world, notes, “capacity represents the amount of bitcoin capable of being transacted with on Lightning, and is a decent metric for measuring the adoption of the network.”

As the technology has advanced and the difficulty of use has decreased, use-cases have proliferated. In their excellent December 2022 report on Lightning, River Financial categorized four different theoretical Lightning user profiles:

Below is a non-exhaustive list of industries and companies currently utilizing the Lightning network (adapted and extended from Roy Sheinfeld’s article on Lightning maturation):

Cross-border remittances (Bitnob, Neutronpay, Pouch)

Gaming (e.g., Zebedee, THNDR Games)

Financial trading (e.g., LN Markets, Kollider, Loft)

News and commentary (e.g., Stacker News)

Power trading and instantaneous energy settlement (e.g. Synota)

Vendor Point of Sale services (e.g. Breez)

Lightning Infrastructure as a Service (e.g. River Lightning Services, Voltage)

Zero-fee donations and crowdfunding (e.g. Tallycoin)

As it relates to the theme of this article, the last use-case above is one of the more interesting ones that saw real-world implementation during the Canadian Trucker Convoy protests in 2022. As the Canadian government systematically pressured centralized donations platforms like GoFundMe to freeze donations and distributions, and used the Emergencies Act to freeze more than 75 individual bank accounts linked to the protests, Bitcoin suddenly found real-world political salience and utility. After the Canadian government began its campaign of politically-motivated financial de-platforming and censorship, a group raised over 14.6 BTC through Tallycoin donations and distributed a significant amount of that directly to protestors using a variety of peer-to-peer means. Read more on bitcoin’s role in the Canadian Freedom Convoy here.

As more people wake up to the myriad benefits of integrating bitcoin into their personal tech stack, not only does price tend to go up, but the need for instantaneous and affordable transaction fees goes up as well. Lightning is enabling this and slowly creeping into industry after industry, including those directly designed to ensure political activists can maintain access to financial resources amidst authoritarian government repression. As you can see above, an ecosystem of vertical markets and burgeoning use-cases are scaling up leveraging Lightning’s ultra low transaction fees and near instantaneous settlement, all while enjoying most of the sovereignty and security enhancing features of the bitcoin base-layer.

Beyond direct donations, one such Lightning use-case is enabling instantaneous value transfer capability embedded into decentralized social media protocols. While this is currently in its infancy, it is rapidly scaling with the potential to usher in a paradigm shift in how human beings interact globally. In Part III of this series, we will cover Nostr, the first fully decentralized social media protocol with native Lightning integration.

Another great article! The links were exhaustive. I appreciate the work you're putting into these.